policy

collection of policy reports published, media coverage, etc.

Preliminary Estimates of the Macroeconomic Costs of Cutting Federal Funding for Scientific Research

Ignacio Gonzalez, Juan Montecino, and Vasudeva Ramaswamy

Institute for Macroeconomic & Policy Analysis, April 2025

Overview:

This brief describes a new analysis of the macroeconomic costs of cutting federal funding for scientific R&D. The brief finds that budget cuts to public R&D would significantly hurt the economy in the long run, with large negative effects on GDP, investment, and government revenue. A 25 percent cut to public R&D spending would reduce GDP by an amount comparable to the decline in GDP during the Great Recession. Cutting annual public R&D spending in half would making the average American approximately $10,000 poorer (in today’s dollars) than the value implied by the historical trend in GDP. Cutting public R&D would also shrink federal government revenue. A 25 percent cut in R&D would decrease revenue by approximately 4.3 percent annually, while a 50 percent cut would decrease it by 8.6 percent annually.

Public engagement:

The Science Coalition, presentation at the Steering Committee Meeting on July 16, 2025. Slides

Macrocast Episode, "The Cost of Federal Funding Cuts for Scientific Research with Dr. Ramaswamy from American University", September 12, 2025. Podcast Link

Media coverage:

The New York Times (April 30, 2025). “Trump’s Cuts to Science Funding Could Hurt U.S. Economy, Study Shows”, Casselman, B.

Forbes (May 01, 2025). “Trump’s College Research Cuts Could Trim GDP By At Least 3.8%, Study Finds”, Nietzel, M. T.

NPR (May 08, 2025). “Economists warn Trump's research cuts could have dire consequences for GDP”, Brumfiel, G.

Redistribution in Reverse: The Macroeconomics of the OBBB with Addendum on the Senate Version

Ignacio Gonzalez, Juan Montecino, and Vasudeva Ramaswamy

Institute for Macroeconomic & Policy Analysis, April 2025

Overview:

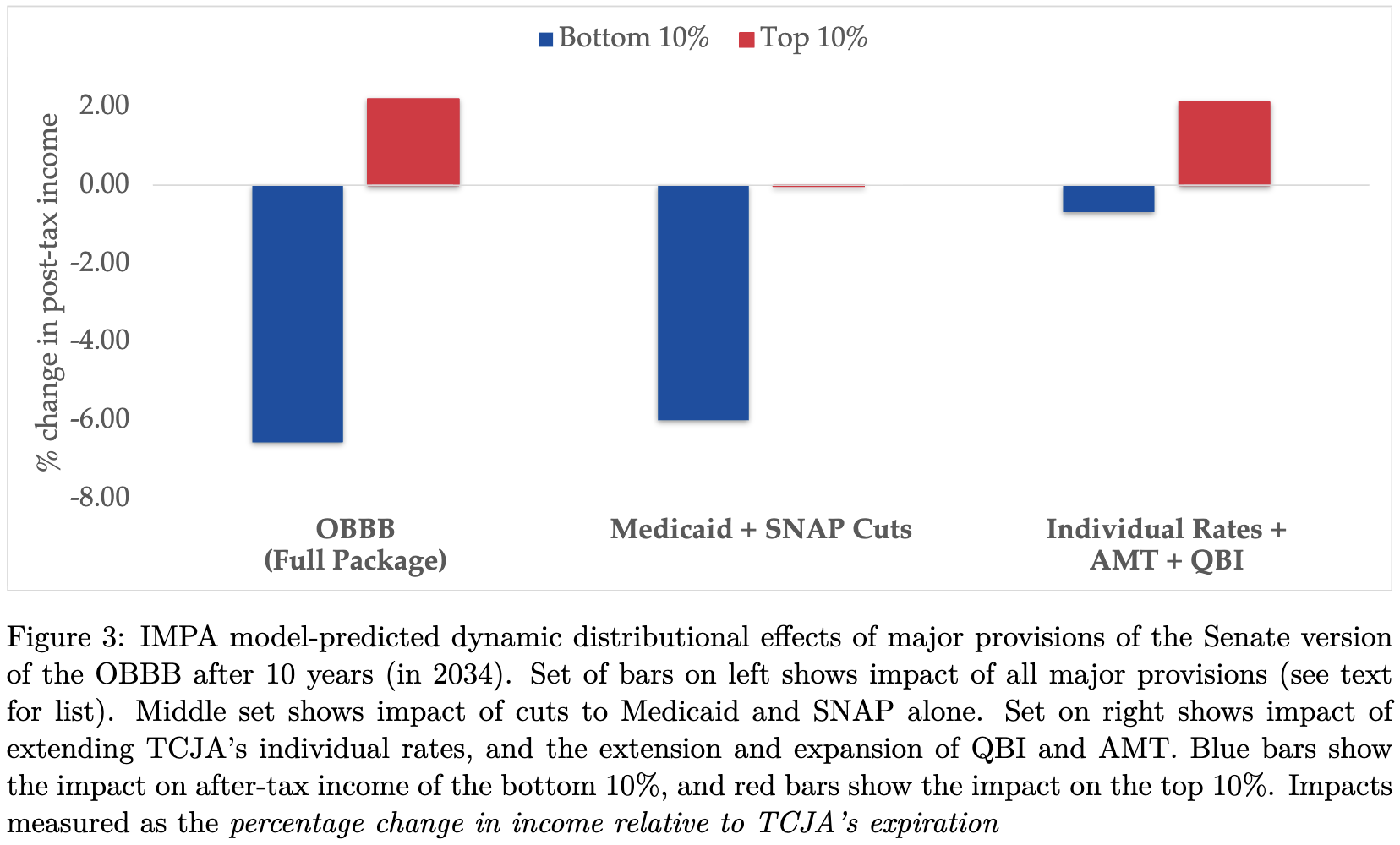

This policy brief evaluates the macroeconomic and distributional impacts of the final version of the One Big Beautiful Bill (OBBB), which closely mirrors the Senate bill. Like earlier versions, it preserves key 2017 Tax Cuts and Jobs Act provisions, prioritizing high-income tax cuts despite limited fiscal space. The final law is broadly “macro neutral,” with a projected GDP decline of 0.08% in 2034 compared to 0.66% under the House bill, but it adds about $421 billion to the deficit over 2025–2034. Making business tax provisions permanent does little to boost growth, leaving federal revenues roughly 7.5% lower in ten years and pushing cumulative deficits to nearly $3.4 trillion. These tax cuts are financed partly through deeper Medicaid reductions, heightening fiscal and economic risks. The distributional effects remain regressive, with gains concentrated among the top 10% and larger losses for the bottom 10% due to Medicaid cuts and less generous temporary relief.

Assessing the Effects of a Dividend and Capital Gains Tax Increase

Ignacio Gonzalez, Juan Montecino, and Vasudeva Ramaswamy

Institute for Macroeconomic & Policy Analysis, June 2024

Overview:

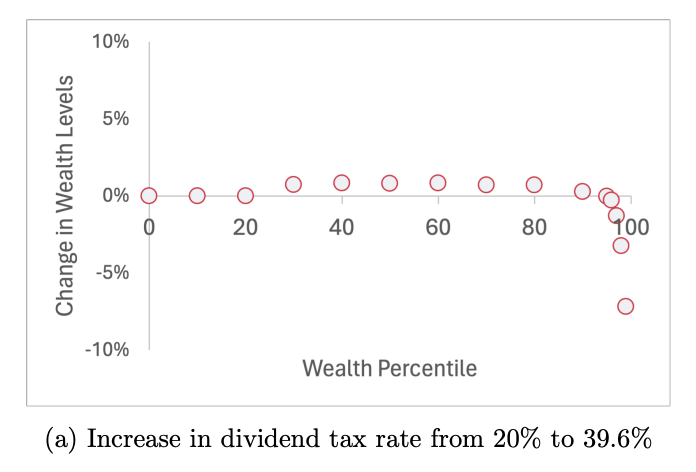

This brief provides a new analysis of the macroeconomic effects of raising taxes on dividend income and capital gains. Increasing dividend income and capital gains taxes from 20% to 39.6% for households earning over $1 million would raise government revenue by about 5% and GDP by about 1% in the long term. The proposed tax increase would increase income for lower- and middle-income households, while households at the top would see a significant decline in income. Because dividend income and capital gains are enjoyed largely by the wealthiest members of society, increasing taxes on income from these sources can play a crucial role in mitigating income and wealth inequality.

Media coverage:

The Hill (June 11, 2024). "Biden’s capital gains taxes would boost economic equality: Analysis", Burns, T.

Politico (June 10, 2024). "Will there be reaching across the aisle?", Becker, B.

Technical Note on Estimating the Overall Effect of Corporate Tax Reforms

Ignacio Gonzalez, Juan Montecino, and Vasudeva Ramaswamy

Institute for Macroeconomic & Policy Analysis, June 2024

Overview:

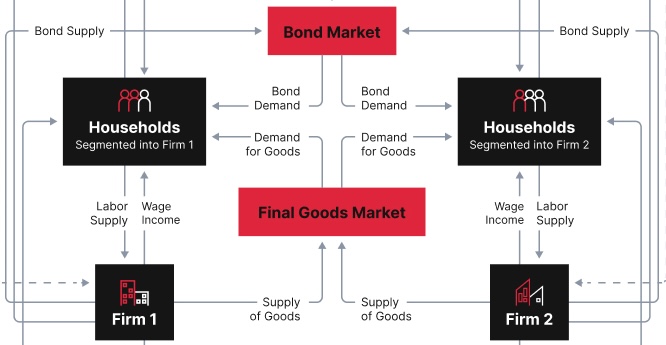

This technical note first describes key differences between estimating the impact of a change in tax policy at the firm (microeconomic) level and at the overall (macroeconomic) level. It then explains how macroeconomic models are used to infer the overall effects of policy reforms and how alternative assumptions—such as the presence of market power—influence these estimates.

Repealing the Clean Energy Credits: A Macroeconomic Assessment of the GOP Proposal

Ignacio Gonzalez, Juan Montecino, and Vasudeva Ramaswamy

Institute for Macroeconomic & Policy Analysis, March 2024

Overview:

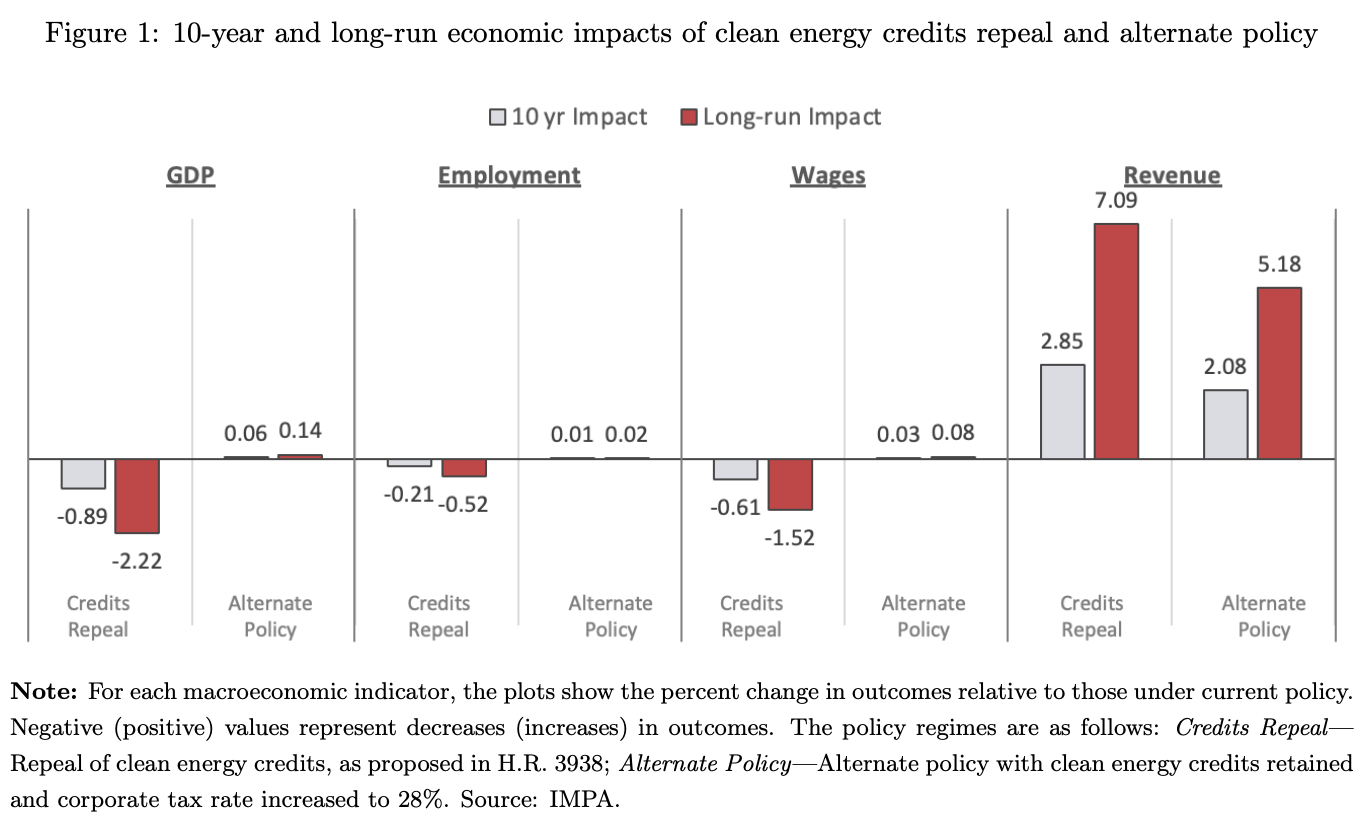

This brief provides an analysis of a Republican proposal to repeal the clean energy credits from the 2022 Inflation Reduction Act. The analysis finds that withdrawal of the clean energy credits would reduce GDP by approximately 2% in the long run from its anticipated level under current policy, while depressing employment and wages by approximately 0.5% and 1.5%, respectively. The proposal to repeal the clean energy credits seeks to reduce the government deficit. The analysis shows that an alternate policy of retaining the clean energy credits, while also raising the headline corporate tax rate to 28%, simultaneously raises government revenue, promotes economic growth, and alleviates wealth and income inequality.

Media coverage:

Bloomberg (March 11, 2024). “HILL TAX BRIEF: Details Due on Biden Budget Tax Hikes, IRS Funds”, Jagoda, N.

Politico (March 11, 2024). “What's in a Deadline?”, Becker, B.