research

publications, working papers, technical reports, and in-progress research.

working papers

-

Capacity Utilization in New Keynesian ModelsIgnacio González, and Vasudeva RamaswamyJul 2025Job Market Paper

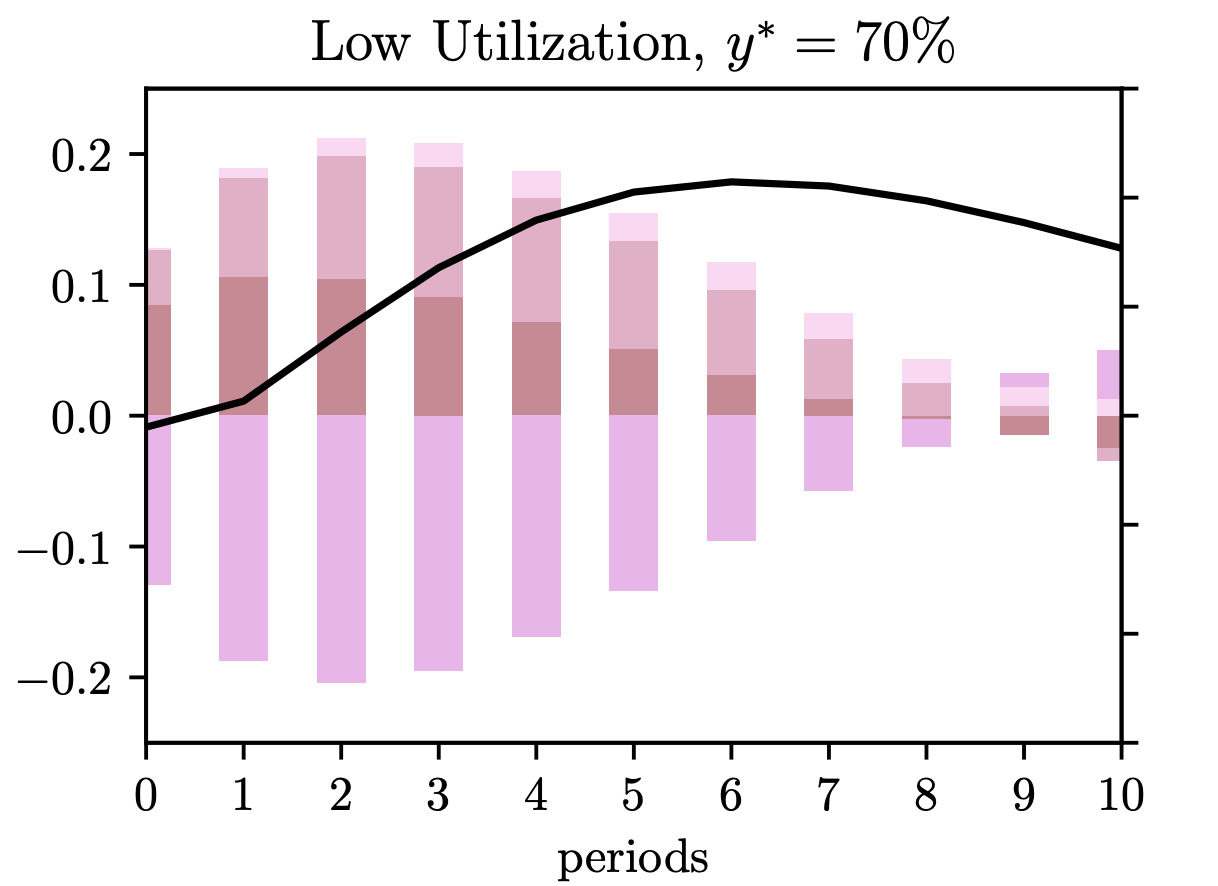

Capacity Utilization in New Keynesian ModelsIgnacio González, and Vasudeva RamaswamyJul 2025Job Market PaperWe introduce endogenous capacity utilization into a New Keynesian (NK) model. In our model, firms set capacity under demand uncertainty, utilizing both an effort margin and capacity expansion to meet demand. This mechanism implies that firm-level productivity and desired markups depend on the capacity utilization rate, enabling us to derive three (state-dependent) results that have proven challenging for NK models. First, following an expansionary demand shock, the aggregate markup responds pro-cyclically when desired markups rise enough to overcome the effect of nominal rigidities. Secondly, the labor share can respond countercyclically for reasons that are empirically consistent, namely, when labor productivity, propelled by the utilization of idle capacity, increases more than wages. Finally, inflation typically displays a hump-shaped response, but can also respond sharply during periods of high capacity utilization due to fast-rising markups and reduced productivity effects. We detail the conditions under which these results arise. Using Bayesian IRF matching, we illustrate that our model provides a highly plausible fit to the data. Our results underscore the importance of capacity for the macroeconomic debate surrounding the determinants, dynamics and distributional effects of inflation.

-

The Huey Long Spending Program in Louisiana: Estimating Fiscal Multipliers during the Great DepressionGabriel Mathy, and Vasudeva RamaswamyMay 2025Submitted for publication

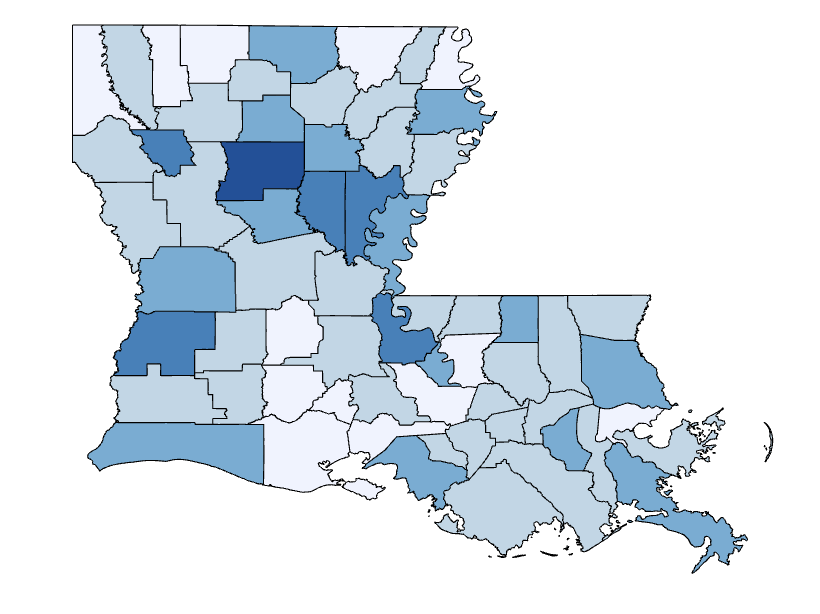

The Huey Long Spending Program in Louisiana: Estimating Fiscal Multipliers during the Great DepressionGabriel Mathy, and Vasudeva RamaswamyMay 2025Submitted for publicationWhat was the economic impact of expansionary fiscal policy during the Great Depression? We revisit this classic question using a unique state-level spending program to shed new light on the subject. Louisiana Governor Huey Long embarked on an ambitious public works and educational spending program on the eve of the Great Depression. We use the variation in state- and parish-level spending prevailing in the economy over the 1930s to estimate fiscal multipliers in the Great Depression. We find a multiplier of roughly 1 for the entire 1929-1939 period and about 1.25 for the 1929-1933 period. These estimates are similar to other studies in the Great Depression like Fishback and Kachanovskaya (2015), but lower than some modern studies at the zero lower bound that estimate the multiplier to be closer to 1.7-1.8 (Chodorow-Reich, 2019). We discuss factors that could explain the lower multipliers amidst record economic slack including a high share of imports, low level of human capital, small domestic production capacity, and corruption. We propose a corruption dismultiplier where corruption results in a lower fiscal multiplier due to measurement error. We use the records of indictments for corruption in the 1939-1940 Louisiana Scandals to try to correct for this error and find larger multipliers if we assume skimming of ≈2%.

in-progress

-

Measuring Corporate Tax Expectations: A New Instrument from Forward-Looking DisclosuresVasudeva Ramaswamy2025

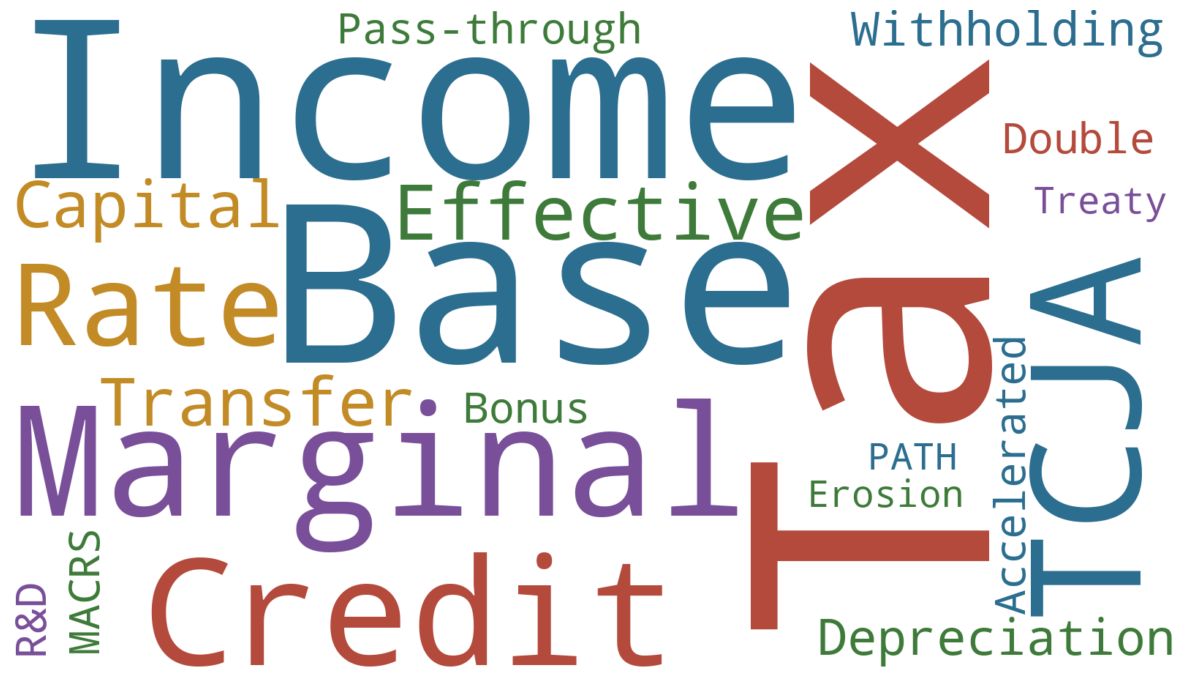

Measuring Corporate Tax Expectations: A New Instrument from Forward-Looking DisclosuresVasudeva Ramaswamy2025This paper proposes a new strategy for identifying the causal effects of corporate tax policy that overcomes the expectations problem, wherein firms respond to a policy before its enactment based on their expectations rather than the policy itself. I develop a novel tax-news instrument that directly measures these expectations by using transformer-based NLP models (BERT) to extract forward-looking statements about statutory rates, depreciation provisions, and other tax-base components from 10-K and 10-Q filings. Because firms are legally required to disclose material policy developments that may affect future profitability, these disclosures offer a credible, real-time proxy for corporate tax expectations. I incorporate this instrument into a structural VAR in the spirit of Mertens and Ravn, which allows me to separately identify the effects of unexpected tax changes and the anticipatory responses triggered by information about forthcoming reforms. Preliminary results indicate that accounting for expectations meaningfully alters estimated tax multipliers and the dynamic responses of investment, employment, and output to corporate tax policy.

-

Labor Share Asymmetry and Monetary PolicyVasudeva Ramaswamy2024

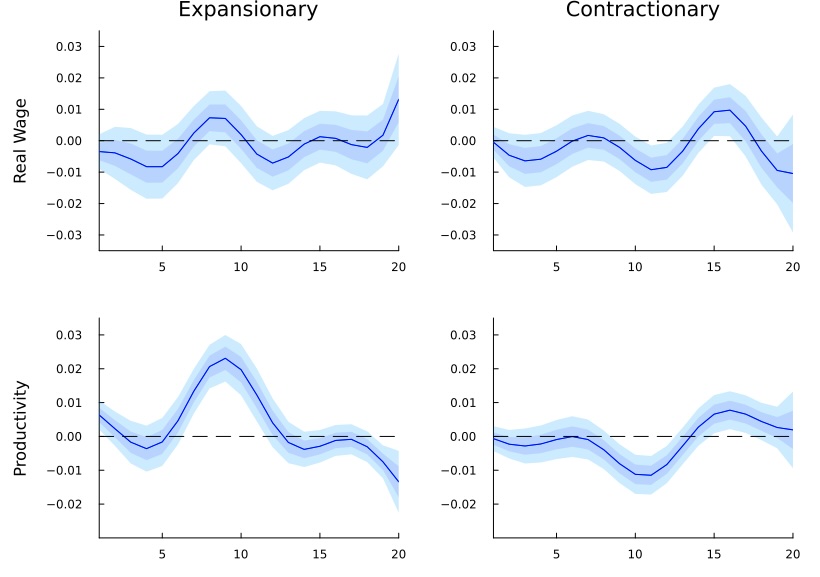

Labor Share Asymmetry and Monetary PolicyVasudeva Ramaswamy2024I uncover a key asymmetry in the response of the labor share to monetary policy (MP). While the labor share is robustly countercyclical to MP shocks in the data, this behavior is driven primarily by a strong decline in response to expansionary shocks. In contrast, the labor share is acyclical or even procyclical conditional on contractionary MP shocks. Decomposing this response, I show that the fall in the labor share following expansionary MP shocks is in turn driven by a sharp rise in labor productivity, while the wage is acyclical. I show that standard New Keynesian models cannot replicate these responses. I account for these facts using a model where firms install capacity ahead of time and respond to demand fluctuations in the short run by adjusting utilization rates. The asymmetry is explained by the fact that the increasing capacity (in response to booms) is a slow process, while firms can easily adjust the intensive margin (capacity utilization) in response to economic contractions.

-

Volatility Clustering with Price and Quantity ShadingAlan G Isaac, and Vasudeva Ramaswamy2024

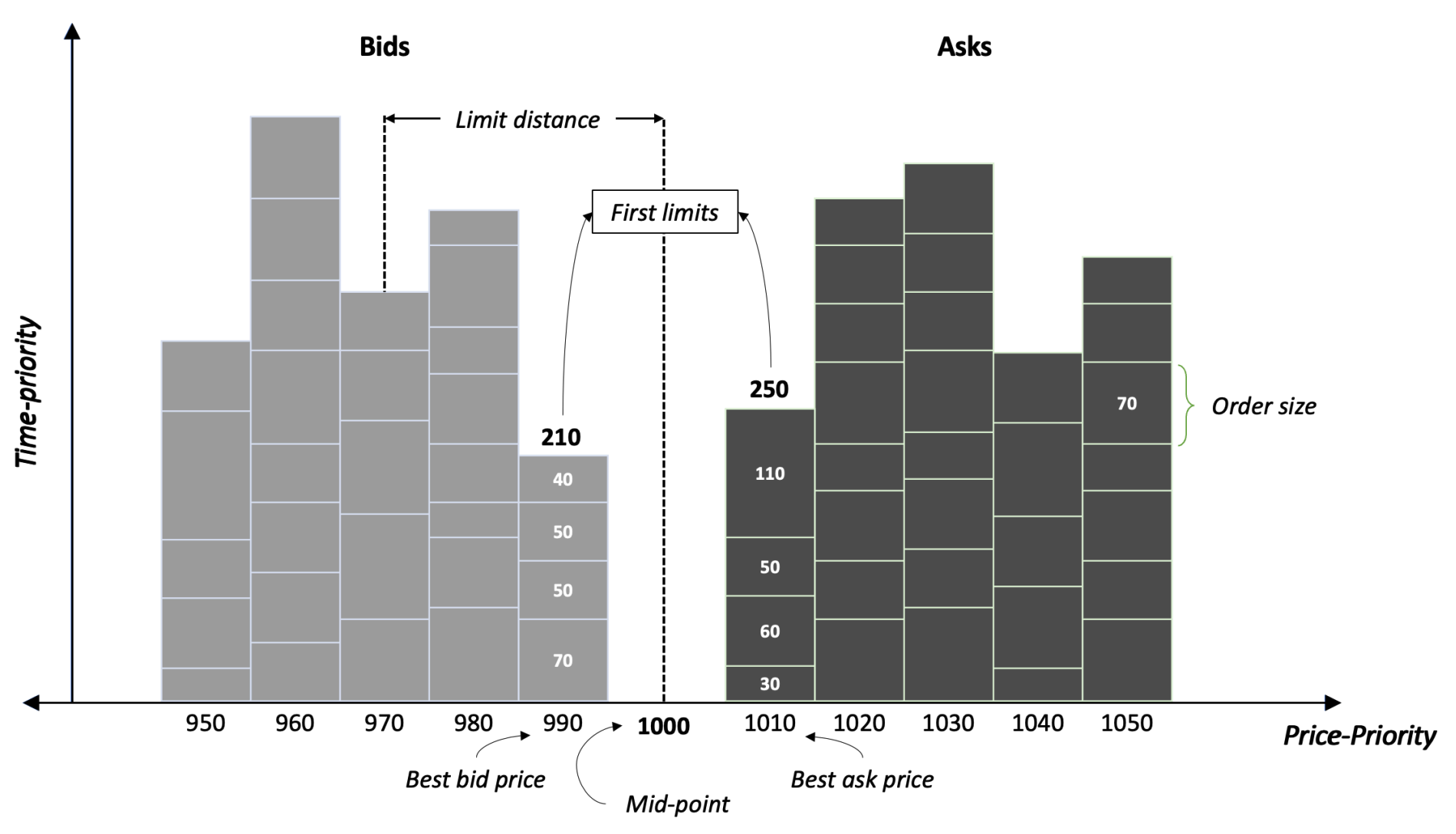

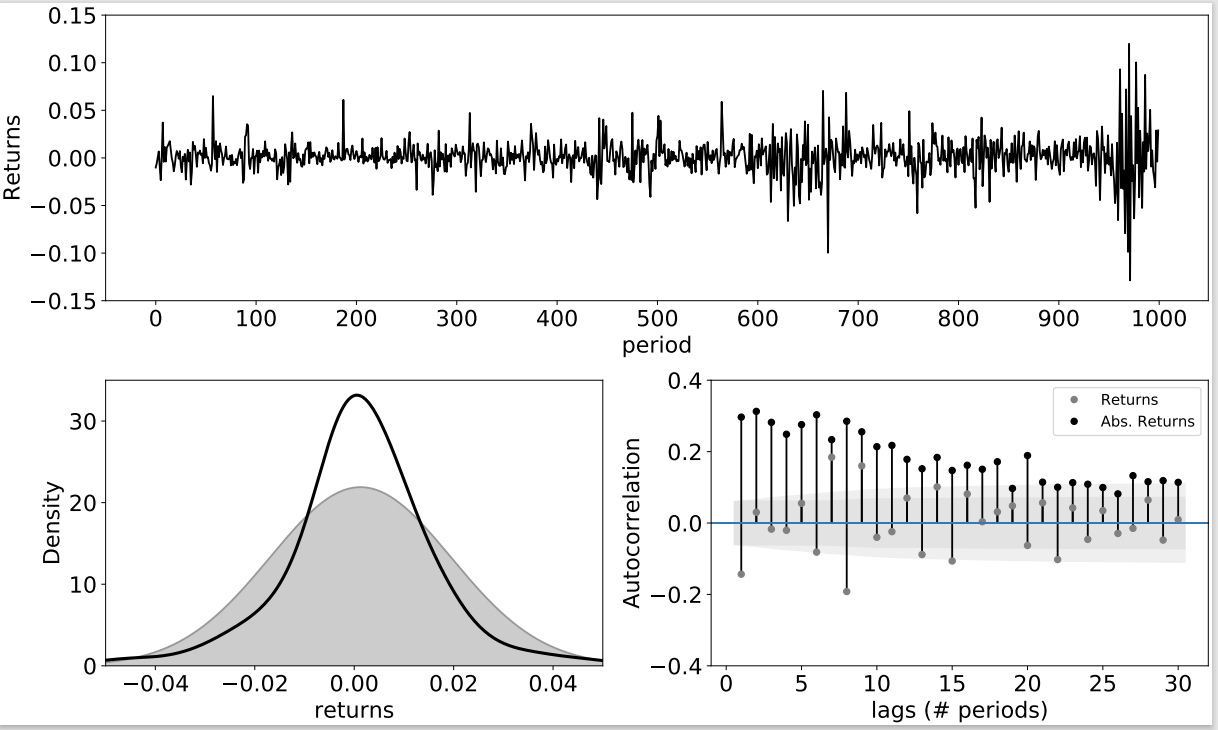

Volatility Clustering with Price and Quantity ShadingAlan G Isaac, and Vasudeva Ramaswamy2024In this paper, we use a simple order-driven model of financial-market microstructure to investigate the volatility consequences of heterogeneous forecasting and trading strategies. Specifically, we investigate if the determinants of order size decisions can produce volatility clustering. We start with the model in Chiarella and Iori (2002), where near-zero-intelligence agents interact indirectly through a limit order book. To this baseline, we add volatility-based shading (LeBaron and Palmer, 2019), where trader behavior alters in response to price volatility. We revisit the findings of LeBaron-Palmer studies, focusing on the features that generate volatility clustering, and extend shading strategies to traders’ order-size decisions. We term this "quantity shading". In the resulting model, order size depends on price aggressiveness and traders’ response to market volatility. The main finding is that when liquidity-providing traders are more quantity sensitive to volatility than liquidity-consuming traders, returns series exhibit clustering and long-range persistence in volatility

publications

-

Rule-based Trading on an Order-driven Exchange: A ReassessmentAlan G. Isaac, and Vasudeva RamaswamyQuantitative Finance, Nov 2023

Rule-based Trading on an Order-driven Exchange: A ReassessmentAlan G. Isaac, and Vasudeva RamaswamyQuantitative Finance, Nov 2023A core research area of computational behavioral finance investigates emergent price dynamics when heterogeneous traders follow a mix of rule-based strategies and interact indirectly through a limit order book. This paper offers a detailed specification of such a model in order to raise questions about some previous findings. The questions force a comprehensive reconsideration of the price dynamics of a well-known model. This leads to a surprising clarification of the contributions of various trading strategies to market outcomes: a popular characterization of chartism proves largely irrelevant for price dynamics. We also shed new light on the volume-volatility relationship, and provide improved visualizations to expose market behavior.

@article{Isaac-Ramaswamy_QF2023, title = {Rule-based Trading on an Order-driven Exchange: A Reassessment}, author = {Isaac, Alan G. and Ramaswamy, Vasudeva}, journal = {Quantitative Finance}, pages = {1--16}, year = {2023}, month = nov, publisher = {Taylor \& Francis}, }